Cannabis Purchasing Trends: Future Winners and Losers

by: Clemens Tscheka

Chief Research Officer

On June 19, the Canadian Senate passed Bill-C45 which is set to mark the end of an era as the Trudeau Liberals in Canada legalize Cannabis across the country. This change will bring about a brand-new industry and a whole host of opportunity for businesses. However, with a budding industry will come growing pains; from potential shortages to lack of retail locations, a struggle is to be expected with such a monumental change.

As the largest Canadian distributor of dry herb vaporizers, we at Torontovaporizer turned to our customers to gain insight on the reception of the legal market. We are curious about people’s purchasing habits and which factors will encourage them to switch from their current Cannabis suppliers, as well as what issues could drive them back into the black market.

The survey was done anonymously and no user data was detailed when answers were collected for the privacy of respondents. At the time of writing, over 1000 people had responded.

Market Share

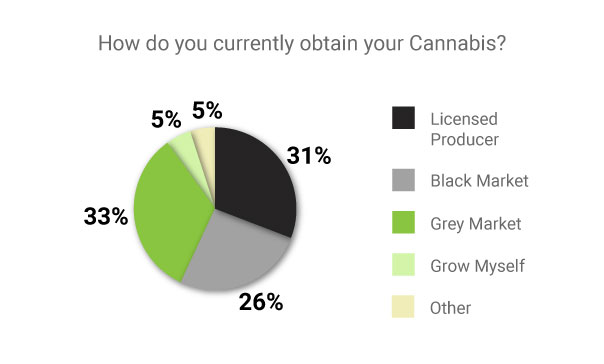

We began the survey by asking customers how they obtain their cannabis in the current legal climate.

When looking at the graph, the “grey market” (e.g. dispensaries, online mail-order cannabis websites) represents the majority with 33% of the results. Licensed producers (currently the only legal resource for Canadian medical patients to purchase cannabis) is close behind with 31% of the results. The Black Market (common dealers) makes up the 3rd largest segment at 26%.

By examining the largest 3 segments, we can see 59% of the market as it currently stands is purchasing cannabis through alternative or illegal channels. By contrast, medical patients purchasing from licensed producers make up for only 31% of the market.

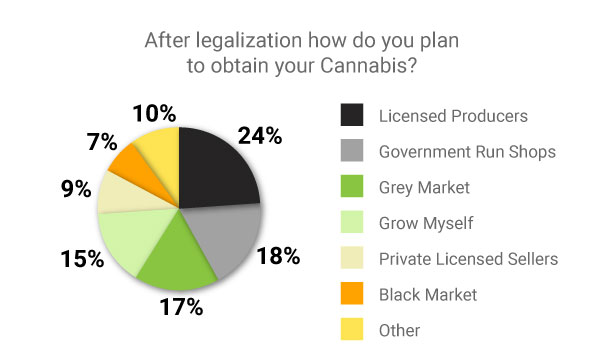

Next, we looked to the future and examined how people planned to purchase cannabis post-legalization.

Government-run retail locations, like Ontario’s proposed “Ontario Cannabis Store” look to take up at least 18% of the market after legalization.

Licensed producers may have some of their market share disrupted by legalization, as only 24% of respondents say they will continue with LPs; this represents a 7% drop from the pre-legal marketplace.

The grey and black markets take the largest hits, with the grey market dropping from 33% to 17% and the black market falling from 26% to a mere 7%, which is the overall goal of this government initiative.

Interestingly, we see a 10% increase in those wishing to obtain Cannabis by growing it themselves. While I think these green thumbs may be slightly ambitious on what they will be able to grow on their own, it’s clear that the interest to grow your own cannabis will increase post-legalization.

If we segment the grey and black market figures and compare them against the legal market, we can hypothesize 51% of the market will be supplied through government-sanctioned cannabis suppliers, while the grey and black markets will be reduced to only 24%.

Pricing

Next, we looked into the factors affecting people switching from black and grey markets towards the legal market. After all, simply making cannabis legal does not ensure everyone will begin purchasing from government-sanctioned shops.

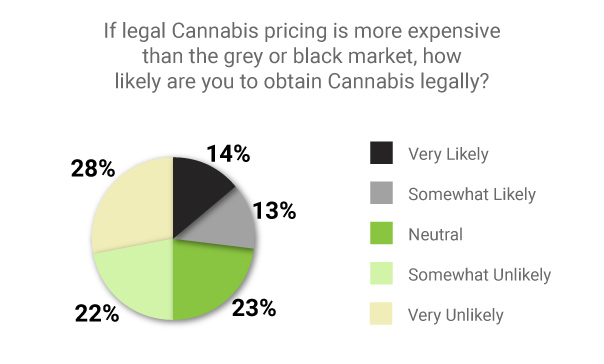

The first factor is pricing. Many consumers have become used to the pricing structure in the current underground marketplace; as well, these same consumers have become accustomed to price breaks when buying in bulk. So, we decided to ask: if legal cannabis is more expensive, how likely are you to buy your cannabis legally?

50% of those surveyed said they are unlikely to purchase cannabis legally if the cost is too high, while only 27% of those who responded said they would likely purchase legal cannabis even if it is more expensive.

It is fairly obvious pricing is going to be a massive factor in deterring people from purchasing cannabis illegally. The government has to be prepared to match (if not beat) current street pricing, or else legalization will have significant difficulty competing with the black and grey market.

Availability

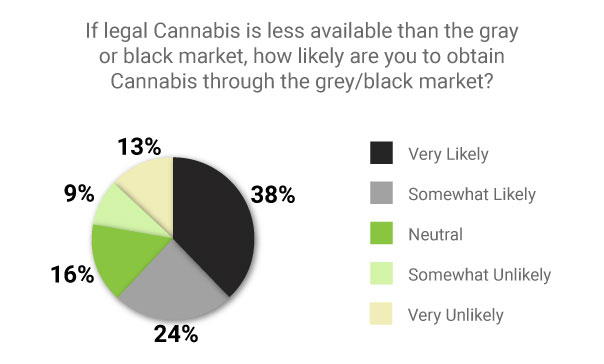

Another significant factor for making cannabis legalization a success is the availability of the products. Many finance-based articles point out the high demand for newly legal cannabis could potentially lead to shortages. Chuck Rifici, chairman and chief executive of Cannabis Wheaton Income Corp. commented on the situation in an article for the Financial Post stating, “I would be shocked if they did not sell out on the first day.”

When asked about availability, 62% of respondents said they are likely to obtain cannabis through the grey or black market if the legal market cannot keep up with demand.

This shows how important it is for the government and respective growers and shops to have supplies readily available from day one if they are ever going to combat the grey and black market during the wake of legalization.

With only 14 cities slated to have stores within Ontario for day one and only 40 opening within the first year, one can only imagine how lineups will be at the beginning, and this could very likely detract many people from obtaining cannabis this way.

Potency

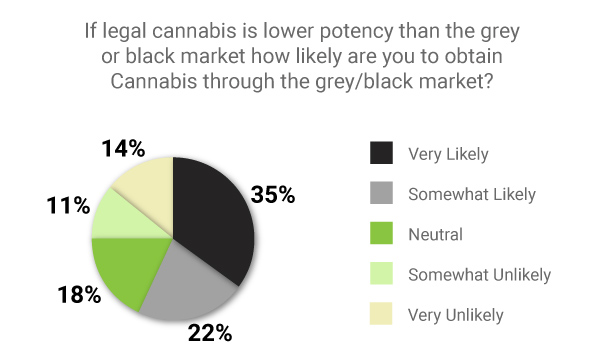

When it comes to legal cannabis, there still is not much information on what the range of potency will be; and with figures like Dr. Christina Grant of the McMaster Children’s Hospital pushing for “limiting THC content in cannabis”, there is a potential for legal cannabis to have caps set for the percentage of THC content.

So, how important is potency to users? When asked if they would purchase legal cannabis if the potency is lower, 57% of respondents said they are more likely to obtain cannabis through the grey and black markets, with only 25% of respondents stating they would be likely to buy legal cannabis with lower potency.

Variety

It’s no secret there are multiple ways people consume cannabis in their daily lives. From dried herb and waxes to edibles and vape pens, countless ways have been created for those to consume.

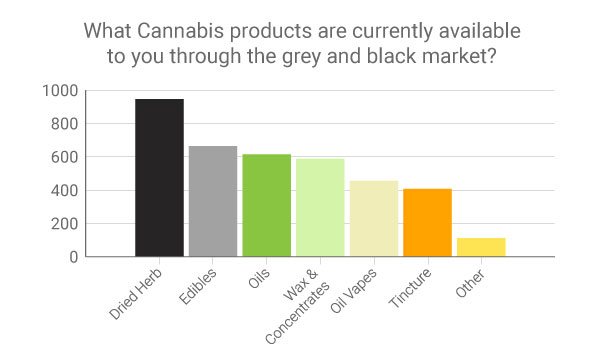

We first asked consumers what types of cannabis products are currently available to them within the current legal climate.

While it’s no surprise dried herb is the most widely available cannabis product, edibles, oils and concentrates are also extremely popular with consumers and are readily available through the grey and black markets as they currently stand.

However, at the beginning of cannabis legalization, only dried flower will be available, leaving those who prefer edibles and concentrates out in the cold.

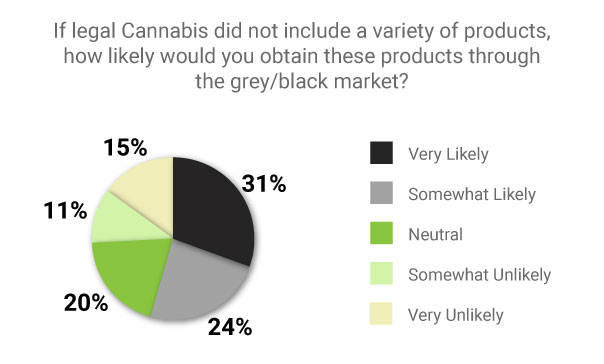

We asked survey takers how they planned to obtain these products if they are not included in legalization.

54% of respondents said they are likely to obtain these other cannabis products through the grey or black markets if they are not available through legal channels,with only 26% of respondents claiming they would not pursue variety outside of legal means.

Luckily, it appears the government understands some of these demands and plans to bring edibles and concentrates to the marketplace a year after legalization.

Ensuring the Success of Legal Cannabis

So, based on our survey data, how does the government plan to ensure the success of the legal cannabis market in Canada? From our data, we have determined there will be four main pressure points for consumers: pricing, availability, potency, and variety.

The government needs to build the legal market with these four pillars in mind; without any one of these, the black and grey markets will likely continue to thrive.

The biggest factors are going to be pricing and availability. Non-competitive pricing and lack of availability will only allow the black and grey markets to flourish especially when consumers will be protected by the law, leaving most of the risk solely on the growers and dealers.

If pricing is immediately competitive and cannabis is readily available and convenient to obtain, then people are more likely to make the switch to the legal market. The current “grey” dispensary market is a perfect example of how easily people will switch to a more structured model for obtaining cannabis if there is a more convenient alternative than waiting on a dealer to respond to a text message (not to mention the eventual awkward meet up). The overwhelmingly positive response to grey market dispensaries has made it pretty clear people are ready for cannabis in a retail capacity. The US is going to have a lot to learn if they want to legalize in the near future.

However, potency and variety are not to be overlooked as main factors for ensuring a successful legal marketplace. If the government cannot meet these demands, people appear more likely to turn to alternative sources for fulfilling their needs. However, if the government is able to supply consumers with a variety of high-quality, potent cannabis products, there will be far less need for people to look elsewhere.

With these pillars in place, a path of least resistance can be created for consumers to obtain cannabis legally, and in doing so will take funds away from the black market, eventually ending it completely. After all, it worked for alcohol, didn’t it? If you are looking for a guide to making your first purchase you can find one here.

We would love to hear from you, leave a comment weighing in on the upcoming plans for legalization!